ASML Holding NV, Europe’s largest technology company and the global leader in semiconductor manufacturing equipment, sought to ease investor nerves on Wednesday after warning of a “significant” decline in China sales next year, even as it reaffirmed its long-term confidence in the chip industry’s transformation powered by artificial intelligence (AI) and advanced manufacturing.

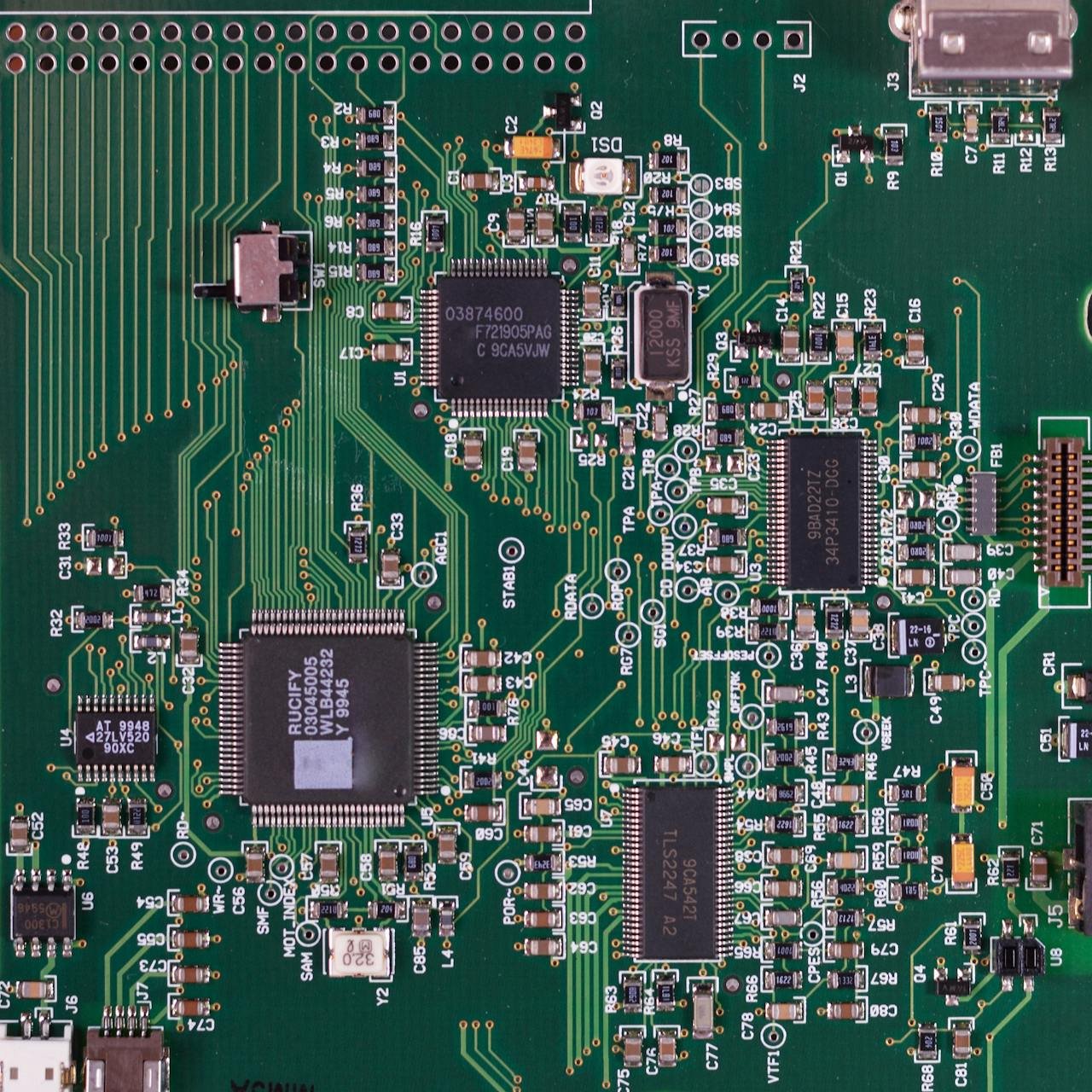

The Dutch chip equipment maker — the only company capable of producing extreme ultraviolet (EUV) lithography machines, vital for manufacturing cutting-edge semiconductors — said it does not expect total net sales in 2026 to fall below 2025 levels, even though demand from China will weaken sharply.

Q3 2025 Financial Performance

- Net Sales: €7.52 billion (vs. €7.79 billion expected)

- Net Profit: €2.13 billion (slightly above €2.11 billion expected)

The earnings highlight ASML’s resilience in a volatile global market. Despite modest revenue pressure, strong demand for AI chips, data center infrastructure, and next-generation computing continues to support the company’s growth outlook.

Shifting Dynamics: From China to Global AI Investments

China, which accounted for nearly one-third of ASML’s sales in 2024, has been a key driver of demand for chipmaking tools. However, escalating U.S. and Dutch export restrictions have constrained ASML’s ability to ship its most advanced lithography systems to Chinese foundries.

In response, the firm has pivoted toward AI-driven investments from global technology leaders such as Nvidia, Intel, TSMC, and Samsung, who are expanding production capacity to meet booming AI and cloud computing demand.

Morgan Stanley and UBS analysts recently upgraded ASML stock, noting that AI hardware buildouts and improving smartphone and PC markets are helping offset regional slowdowns.

“ASML is positioned at the technological heart of the semiconductor revolution,” said Lars de Groot, a semiconductor industry strategist based in Amsterdam. “Even with geopolitical limits, the global push for AI computing power ensures steady tool demand.”

Technology Leadership and Strategic Partnerships

ASML’s EUV and deep ultraviolet (DUV) lithography systems are fundamental to producing the smallest and most powerful chips in the world. Its innovation pipeline continues to expand, supported by collaborations with global chipmakers working on 2-nanometer and sub-2-nanometer nodes.

Industry watchers say the company is poised to benefit from the $5 billion semiconductor equipment investment deal between Nvidia and Intel, which is expected to stimulate demand across ASML’s product line.

“Every leap in AI processing capability directly translates to more complex chip architectures — and more ASML machines,” said Anita Huang, head of technology equity research at TechVista Partners.

Navigating Export Controls and Future Growth

ASML has found itself navigating complex geopolitical terrain. While the Netherlands has aligned with U.S.-led export bans, the firm continues to supply non-EUV systems to Chinese clients under government license.

CEO Peter Wennink reiterated that global diversification in chip manufacturing — with new fabs under construction in the U.S., Japan, and Europe — provides “multiple growth pillars” beyond China.

“AI and high-performance computing are redefining semiconductor demand,” Wennink said. “ASML’s technology remains at the core of enabling that progress, regardless of short-term trade dynamics.”

Looking Ahead:

Despite uncertainty in the Chinese market, ASML maintains a cautiously optimistic view for 2026 and beyond. With its technological dominance, global customer base, and strategic positioning at the intersection of AI, automation, and advanced lithography, the company continues to be seen as the backbone of the modern semiconductor ecosystem.