Asian equities traded with caution on Wednesday as a more optimistic tankan survey in Japan prompted speculation about BOJ tightening, while the Reserve Bank of India opted to maintain its policy rate amidst mixed domestic conditions.

The BOJ’s quarterly tankan survey showed improving business sentiment: the large manufacturers’ index rose to +14, and the non-manufacturers’ index held at +34. Firms also raised capital expenditure expectations to ~12.5%. Asian equities traded with caution on Wednesday as a more optimistic tankan survey in Japan prompted speculation about BOJ tightening, while the Reserve Bank of India opted to maintain its policy rate amidst mixed domestic conditions.

The BOJ’s quarterly tankan survey showed improving business sentiment: the large manufacturers’ index rose to +14, and the non-manufacturers’ index held at +34. Firms also raised capital expenditure expectations to ~12.5%. The survey strengthens the case for a BOJ rate hike, as hawkish voices within the board grow louder.

Still, the forward-looking components flagged concerns—companies foresee weakening conditions amid U.S. trade headwinds, labor costs, and weaker domestic demand.

In India, the RBI held its repo rate at 5.5%, reaffirming a neutral stance. Its revised forecasts are reflective of ongoing inflation moderation and economic resilience. While inflation is broadly under control, slower growth and weakening currency placed constraints on aggressive easing.

Still, the forward-looking components flagged concerns—companies foresee weakening conditions amid U.S. trade headwinds, labor costs, and weaker domestic demand.

In India, the RBI held its repo rate at 5.5%, reaffirming a neutral stance. Its revised forecasts are reflective of ongoing inflation moderation and economic resilience. While inflation is broadly under control, slower growth and weakening currency placed constraints on aggressive easing.

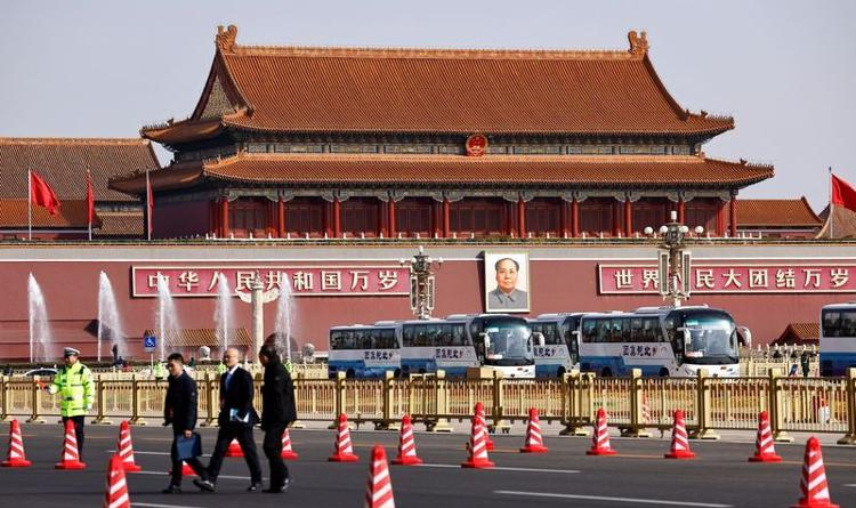

Regional markets reflected divergent dynamics. Japan underperformed given export pressures, while Taiwan and South Korea led with tech gains. Australia’s markets slipped slightly. The Chinese markets remained closed due to national holidays.

Investor attention now turns to upcoming inflation data, central bank decisions globally, and the potential impact of a U.S. budget impasse, which could delay key economic releases.