Wall Street’s latest move on immigration has global implications. President Trump announced that every company seeking new H-1B visas will now be required to pay $100,000 annually per visa, a radical jump from prior fees. That policy, part of an immigration crackdown, is already affecting investor sentiment worldwide.

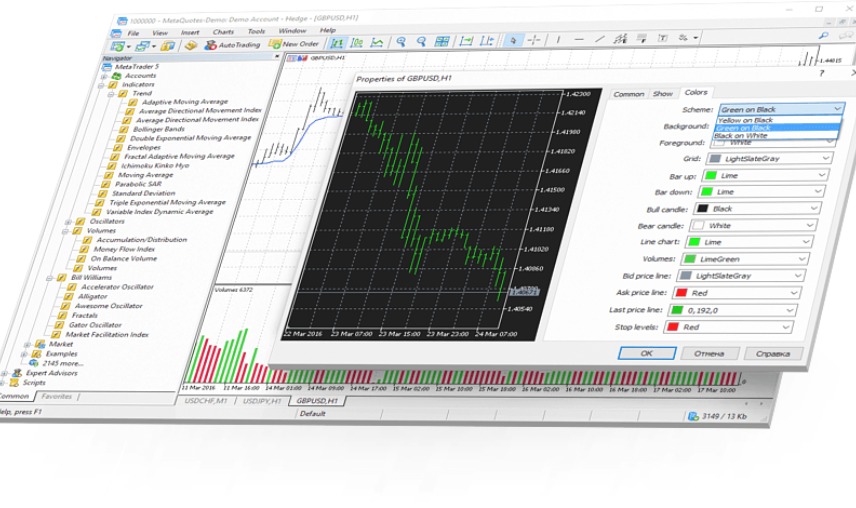

In Europe, trading in U.S. tech stocks has remained surprisingly steady. The Magnificent Seven saw share price changes between slight losses and modest gains (around +1.1%), especially in markets such as Frankfurt, where many of these stocks are traded as ADRs or by global funds.

India’s information technology sector was one of the hardest hit in Asia. The NIFTY IT index dropped around 2.6%, with leading companies such as TCS, Infosys, Wipro, and Persistent Systems down between 2-4%. Investors worried about how the fee could raise operational costs and reduce margins.

Clarifications followed: the fee rule only pertains to new visa applications. Existing visa holders and those renewing are not subject to the new regime. Still, initial market reactions suggest uncertainty remains high among firms and workers anticipating long-term planning.

Meanwhile, monetary policy remains on the radar. Investors are also closely watching Federal Reserve signals, as expectations of additional rate cuts before year-end are influencing risk appetite in equities.