Nvidia Corp. reached a momentous milestone on Tuesday, becoming the first publicly listed company to cross a $4 trillion market capitalization, eclipsing both Apple and Microsoft in a seismic shift in global tech market leadership.

Shares of the Santa Clara-based chipmaker rose 2.5% to $164, bringing its total valuation to $4.05 trillion. This historic leap places Nvidia at the summit of the corporate world, thanks to its indispensable role in the AI revolution.

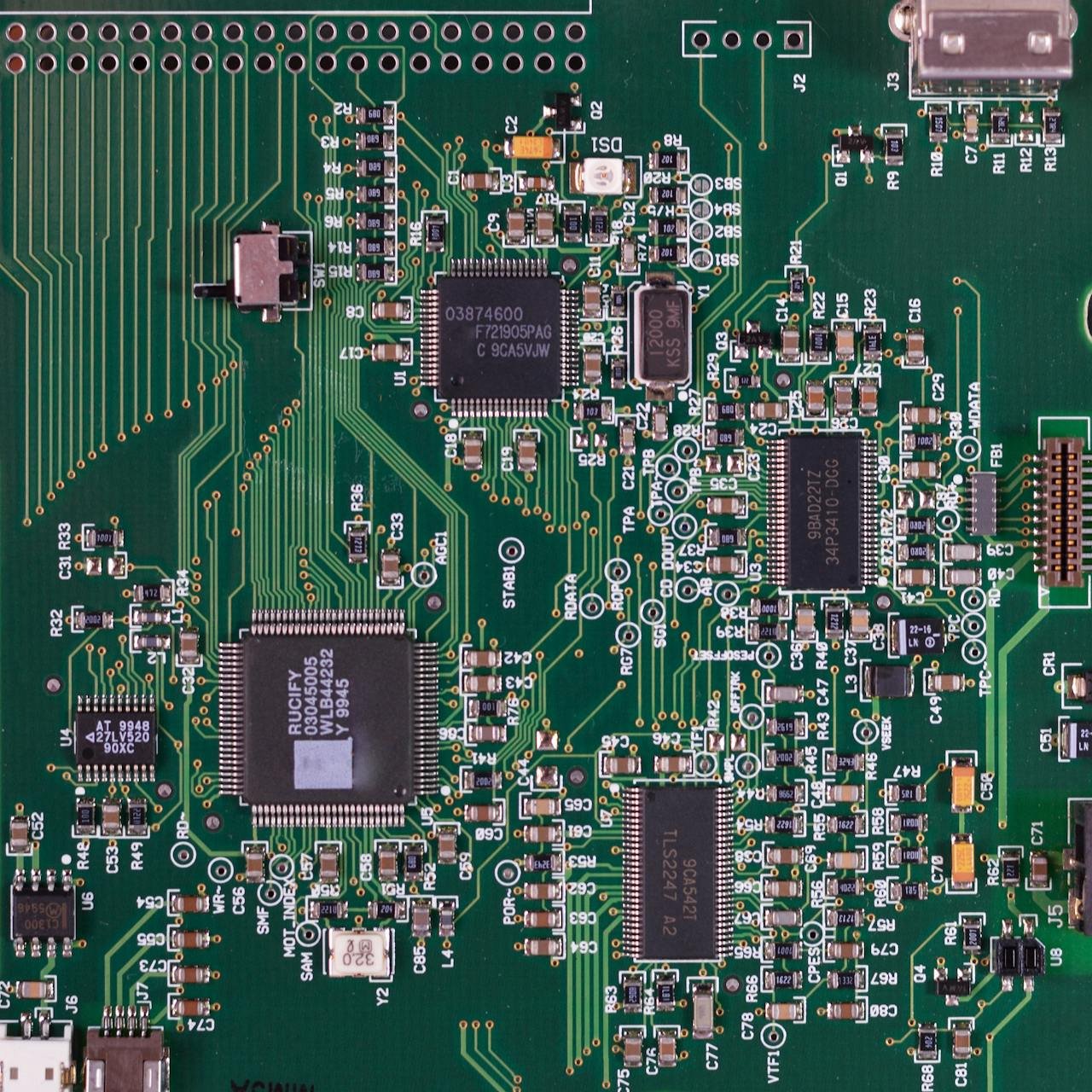

The company’s meteoric rise has been powered by its commanding hold over the AI semiconductor market. Nvidia’s GPUs are central to the infrastructure supporting large-scale AI applications—from training language models and powering data centers to enabling autonomous systems. It now sits at the heart of a rapidly expanding digital economy built on AI computing.

CEO Jensen Huang, once considered an underdog in Silicon Valley, now leads what many analysts are calling “the most valuable company of the AI age.” Over the past 18 months, Nvidia’s valuation has more than tripled as demand for its high-performance chips—including the H100 and upcoming Blackwell series—far outpaces supply.

The valuation not only reflects bullish investor sentiment but also underscores the broader structural shift in global tech investing. Traditional software and device companies like Microsoft and Apple, long dominant, now trail Nvidia’s fast-evolving hardware ecosystem.

Despite concerns about overheating, Wall Street remains largely optimistic. The company’s next earnings report is expected in August, and early signals suggest continued triple-digit growth. Several institutions have raised their price targets, citing expanding margins and long-term AI spending by governments and enterprise clients.

However, caution is warranted. Analysts warn of potential volatility ahead as the company’s enormous valuation sets high expectations. Any slowdown in chip demand or geopolitical disruption in the tech supply chain could rattle investors.

Still, Nvidia’s rise is nothing short of historic. It has transformed from a gaming GPU vendor into the cornerstone of the global AI economy—rewriting what’s possible for public companies and tech innovation alike.