The landmark adoption of a $50 per ton carbon tax by 13 Asian nations triggered a dramatic rally in renewable energy equities, catapulting shares of battery giant CATL (+12%), wind turbine leader Goldwind (+9%), and solar innovator Tata Power (+7%) to multi-week highs as investors bet on accelerated green energy adoption.

Deal Highlights:

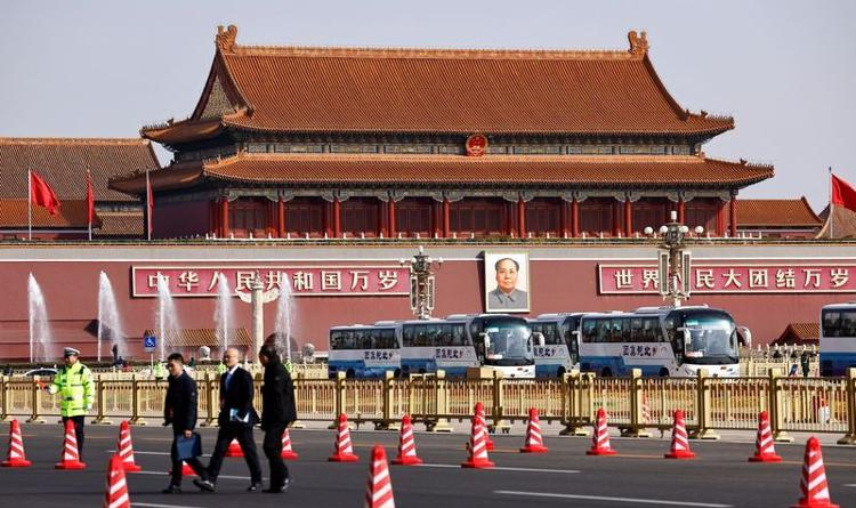

- Signatories: China, Japan, India, Korea, and ASEAN states.

- Implementation: Phased rollout from 2026–2030, with $10B/year in green subsidies.

- Exemptions: Aviation and agriculture sectors deferred until 2032.

Winners & Losers:

- Battery Makers: CATL’s $5B Indonesia gigafactory gains tax breaks, bolstering the nation’s EV battery leadership under new carbon tax rules.

- Coal Utilities: China’s Huaneng Power (-15%) faces $2B in annual carbon costs.

- EV Sector: BYD (+8%) plans to triple exports to Europe.

India’s Green Push:

- National Hydrogen Mission: Reliance Industries (+5%) to build 20GW plants by 2030.

- Solar Tariffs: 40% duty on Chinese panels to boost domestic manufacturing.

Criticism:

- Enforcement Gaps: No penalties for non-compliance until 2028.

- Energy Poverty: Southeast Asia’s power costs may rise 20%, per World Bank.

Expert Insight:

“This accelerates Asia’s energy transition but risks inflationary shocks,” said Wood Mackenzie’s Prakash Sharma.