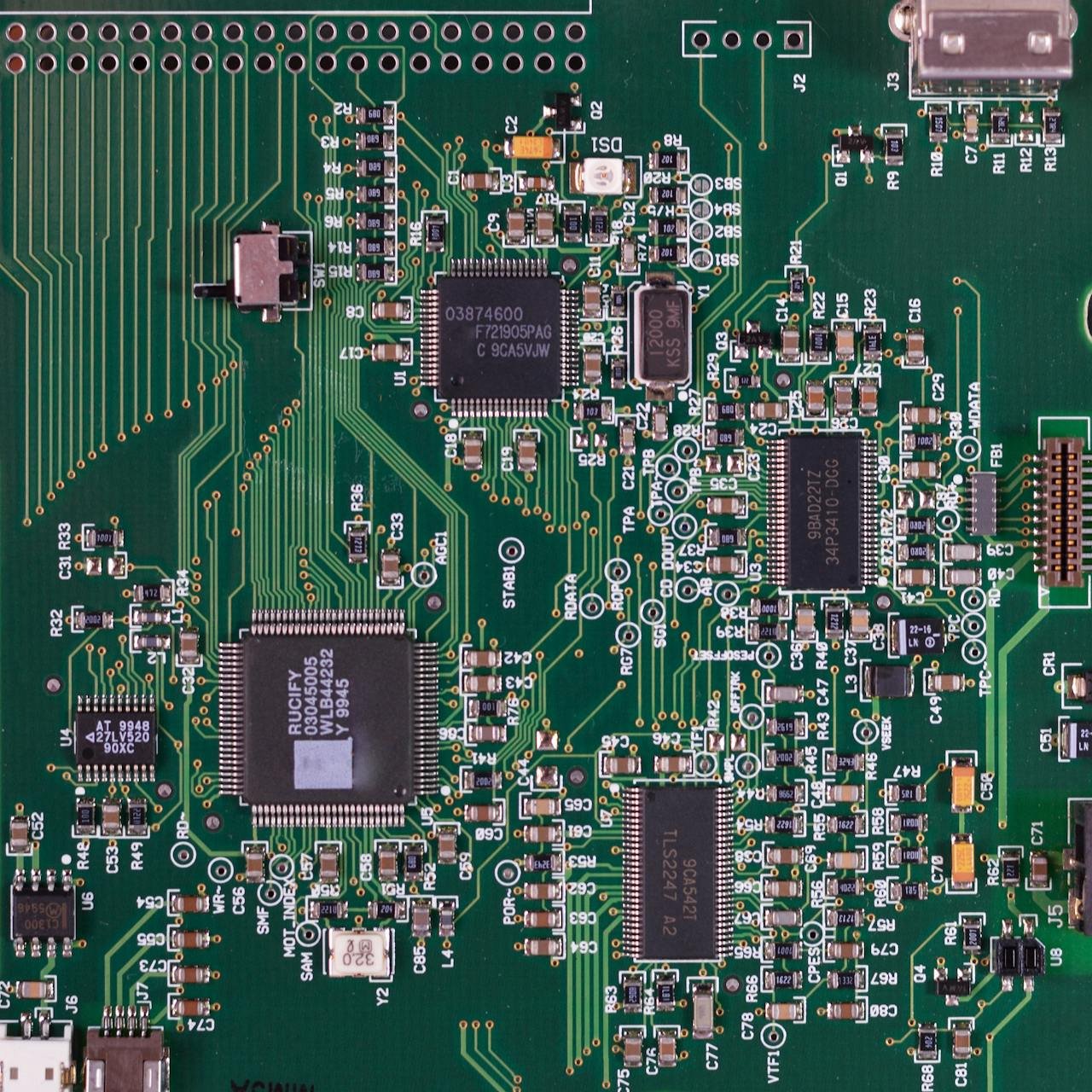

Volkswagen’s Q1 2025 net profit fell 5% year-over-year to €3.8 billion ($4.1 billion), falling short of analyst forecasts as inflationary headwinds and persistent supply chain disruptions—including semiconductor shortages and logistics delays—eroded margins, despite a 28% surge in electric vehicle sales.

Revenue edged up 4% to €72 billion, but operating margins contracted to 6.5%—down from 7.3% in the prior-year quarter—as supply chain inefficiencies took a toll. CFO Arno Antlitz pointed to ‘unforeseen component delivery delays’ as a key factor but reiterated the company’s full-year targets, anticipating a stronger second half.

The automaker’s China joint ventures underperformed, with deliveries down 12%. Shares dropped 3% in early trading.