SoftBank’s acquisition of ABB’s robotics unit for $5.4 billion is bold — but integrating it successfully into a sprawling AI-robotics empire will not be easy. Execution risks abound.

Key challenges include:

- Cultural and organizational alignment: ABB’s engineering heritage may differ markedly from SoftBank’s agile AI startup ethos.

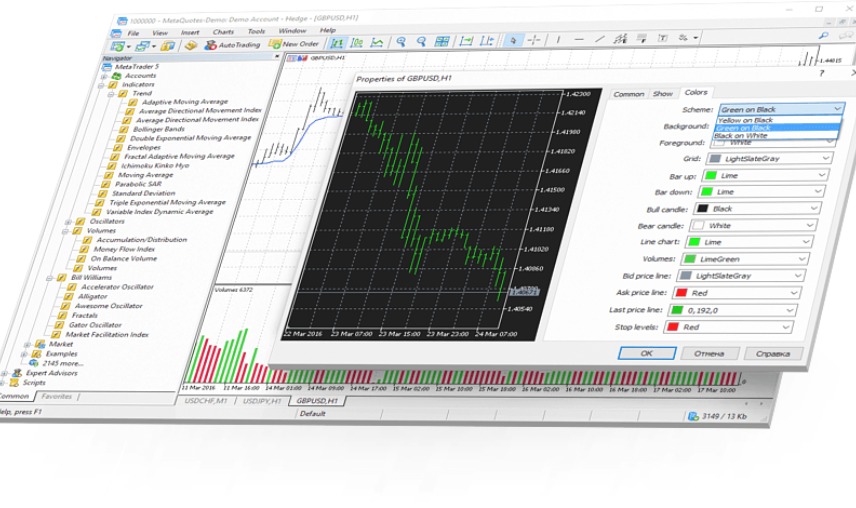

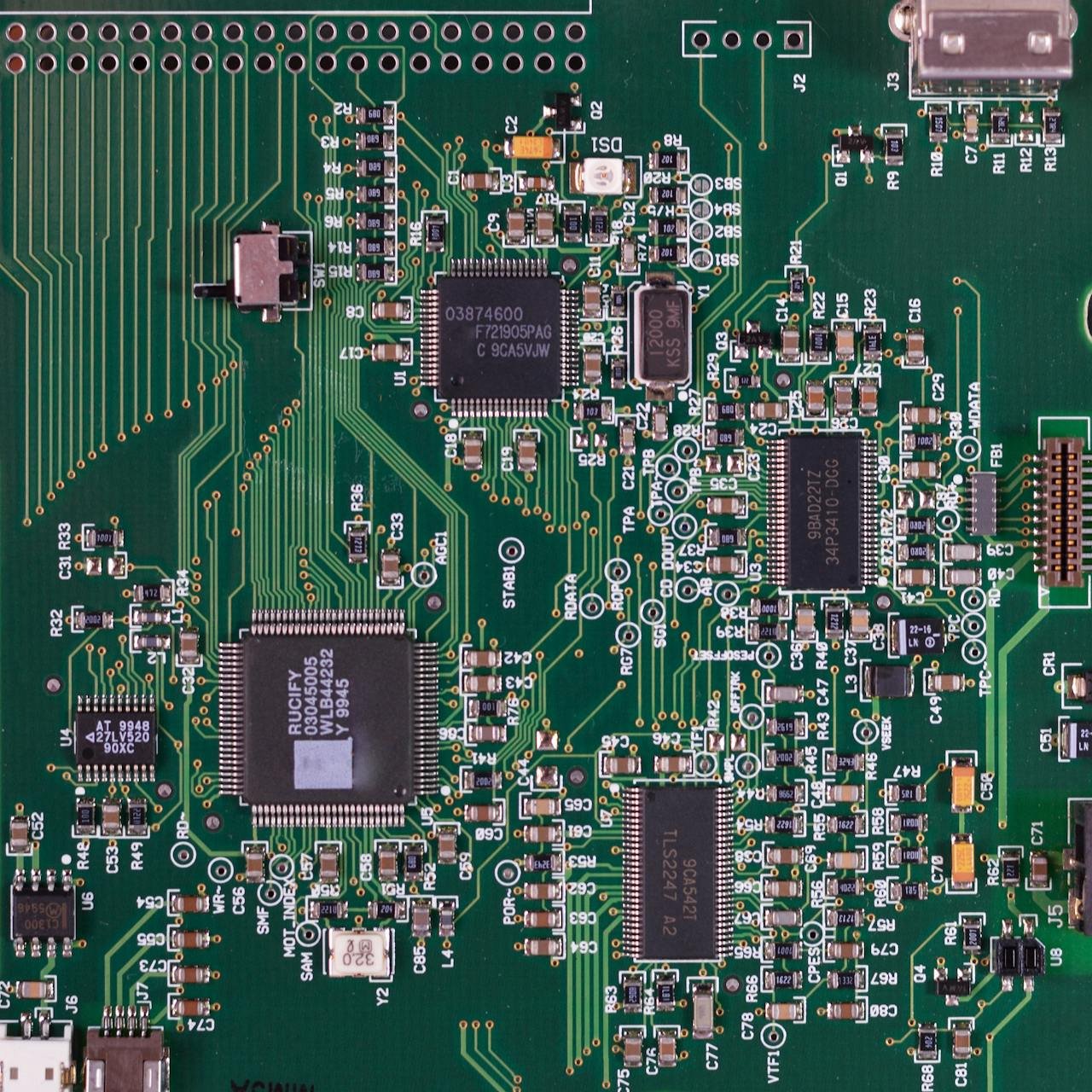

- Technology integration: Merging legacy robotics systems, control software, sensors, and AI layers will demand seamless architecture alignment.

- Operational synergies: Realizing cost savings or cross-selling opportunities across robotics, AI, and automation divisions will require coordination across geographies and domains.

- Regulatory & global approvals: A transaction of this scale must clear multiple regulatory regimes — any hold-ups could delay synergies or result in divestment requirements.

SoftBank acknowledged that the exact financing plan is not yet finalized, suggesting it may lean on a combination of internal cash, asset-backed financing, and debt instruments.

From ABB’s perspective, abandoning the spin-off plan in favor of a sale changes risk profile and stakeholder expectations. The robotics division’s profit decline in recent years heightens the urgency for operational turnaround.

While the ambition is large, investors will be watching whether SoftBank can capture synergy value while preserving engineering excellence, controlling costs, and executing efficiently.