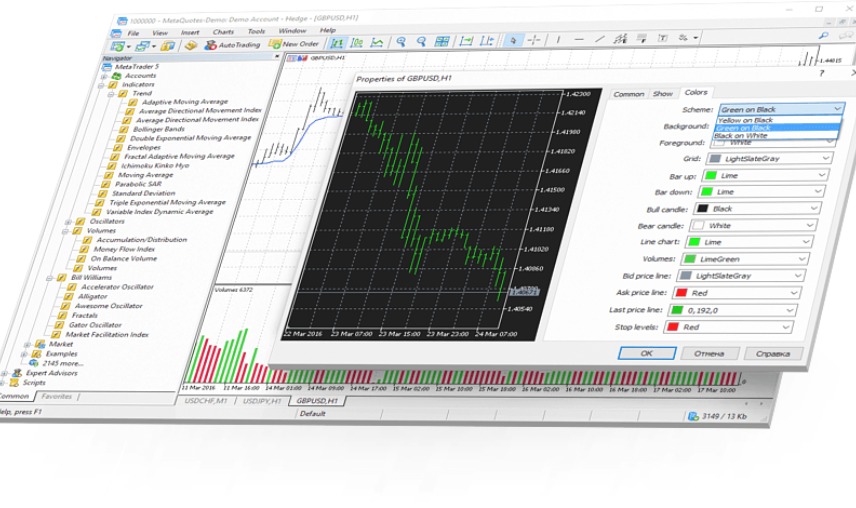

As ChatGPT hits its third year, more retail investors are using it or similar AI models to answer “what stocks should I buy?” This shift is accelerating growth in the robo-advisor market, which offers algorithmic portfolio management.

Forecasts see the robo-advisor industry swelling from $61.75B to $470.91B by 2029, fueled by broader AI adoption. Meanwhile, surveys indicate 13% of retail investors already use AI tools for stock selection, and nearly half would consider doing so.

A ChatGPT-generated sample basket achieved ~55% gains, surpassing many active funds. However, industry analysts caution that this performance hinges on correct prompts and data quality.

Dan Moczulski warns that using generic models like ChatGPT as do-all advisors can lead to errors and overconfidence. Jeremy Leung mitigates risk by instructing the model to rely on credible sources only.

In sum: AI is lowering the barrier to investment insight, but users must complement it with domain knowledge and risk awareness.