The technology sector has emerged as a significant beneficiary of the recent 90-day tariff reduction agreement between the United States and China. Major tech companies, including Apple, Amazon, and Tesla, have seen their stock prices rise sharply in response to the easing of trade tensions.

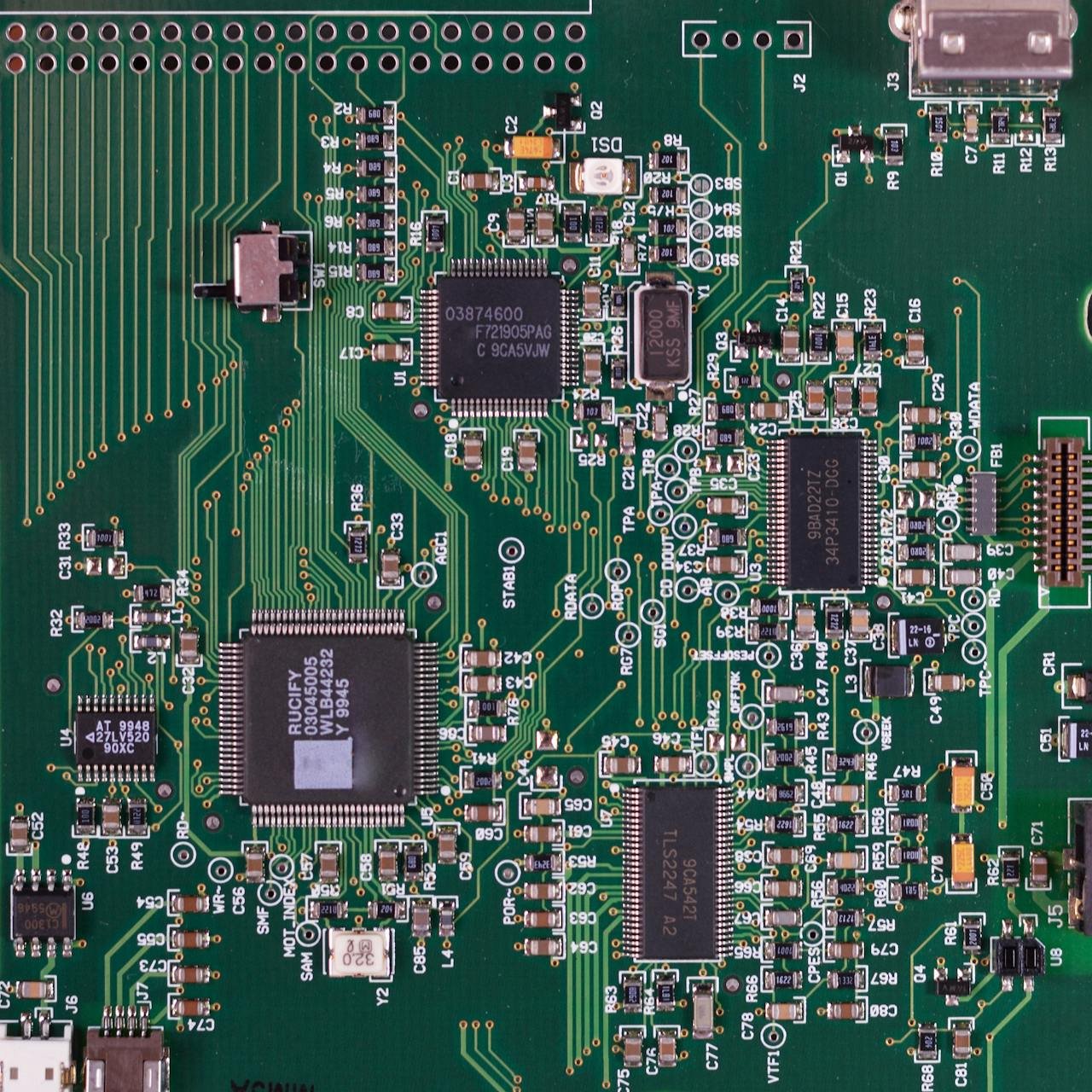

Investors are optimistic that the reduction in tariffs will lower costs for technology supply chains, enhance product availability, and stimulate consumer demand. Industry leaders believe that the easing of tariffs could accelerate hardware shipments and reduce production costs for electronics manufacturers.

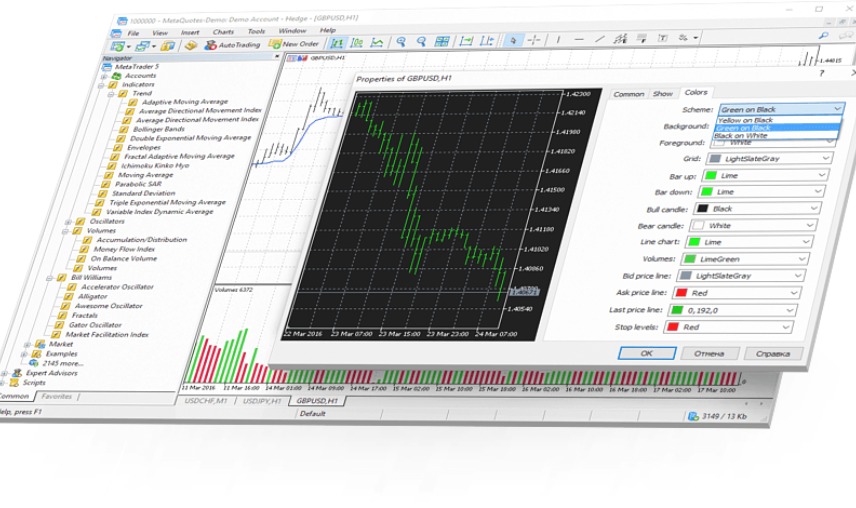

The Nasdaq Composite, heavily weighted with tech stocks, climbed more than 2% in the days following the announcement, reflecting strong investor enthusiasm. Semiconductors and consumer electronics led the charge, with companies like Nvidia and Intel registering double-digit gains over the week.

While the 90-day reduction is temporary, it offers critical breathing room for tech firms previously hampered by escalating trade barriers. Market watchers suggest this period could serve as a precursor to a more long-term resolution, potentially reshaping supply chain strategies and future investments.