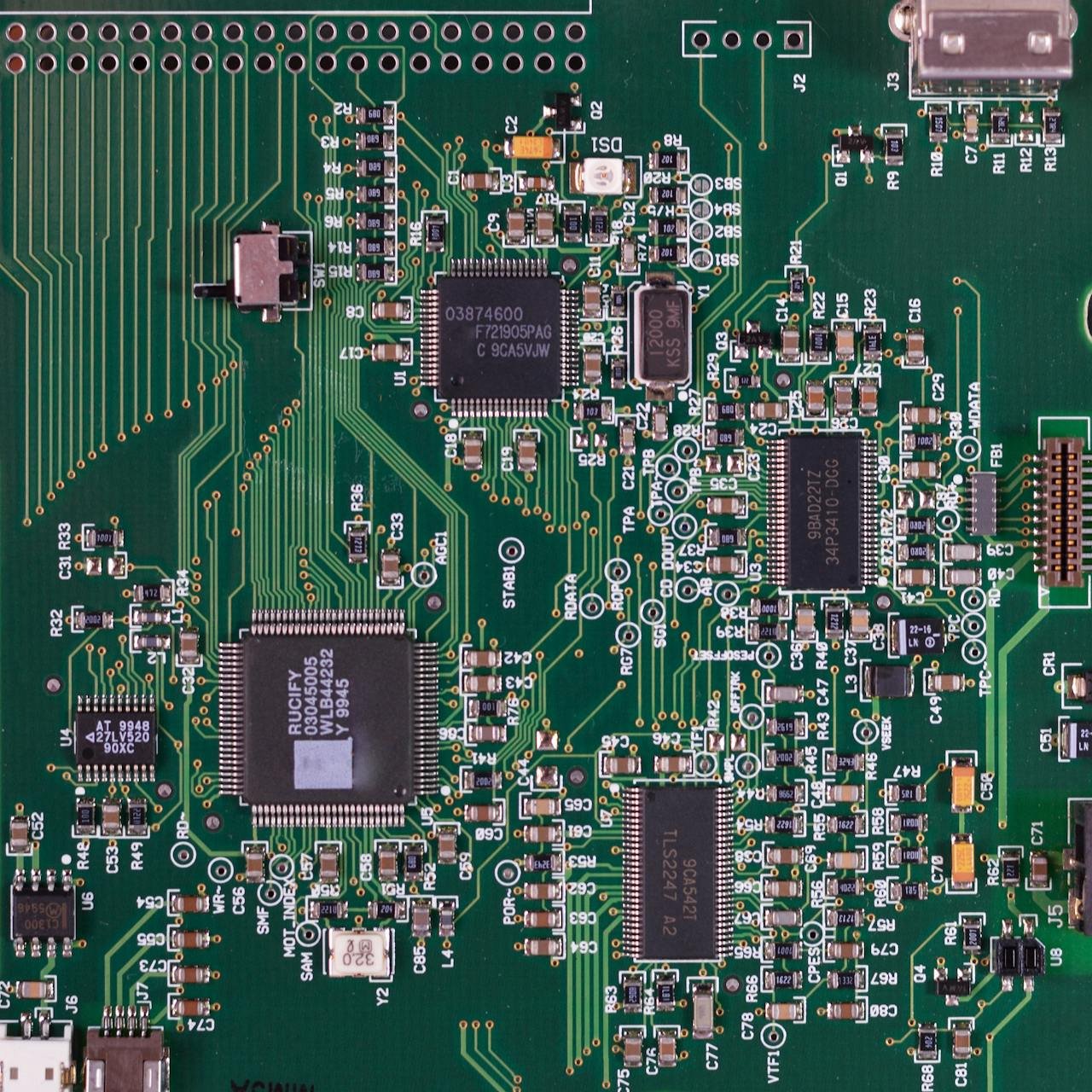

Asian technology and semiconductor stocks faced a steep decline on Tuesday after U.S. President Donald Trump announced increased tariffs on imports from Canada, Mexico, and China. Trump confirmed that 25% tariffs on Canadian and Mexican goods would proceed as planned, with no room for negotiation, and added a 10% hike on existing tariffs on Chinese imports.

The announcement sent shockwaves through Asian markets, with tech and chip stocks bearing the brunt of the sell-off. Japanese semiconductor equipment manufacturer Advantest plummeted 9%, hitting its lowest level since late October, while Renesas Electronics dropped 6.35%. SoftBank Group, a major tech investor, fell 6.25% amid reports of its CEO’s $16 billion AI investment plan.

In South Korea, Samsung Electronics saw a modest 1% rise following the launch of its AI-powered Galaxy A series, but SK Hynix fell 3.26%. Chinese tech firms Alibaba and Kingsoft Cloud dropped 2.23% and 8.46%, respectively. Electric vehicle makers Xpeng, Li Auto, and BYD also faced declines, with BYD plummeting 6.60%.

Taiwan Semiconductor Manufacturing Company (TSMC) fell over 2% despite Trump’s praise for its $100 billion U.S. investment in semiconductor production. Investors remain on edge as the tariff hikes threaten to disrupt global supply chains and exacerbate trade tensions.