In response to President Donald Trump’s recent 25% tariff on steel and aluminum imports, several Asian economies are actively adjusting their trade policies to mitigate potential economic disruptions. With the U.S. emphasizing trade rebalancing, key Asian nations are employing strategic trade measures to maintain economic stability.

Asian Economies Expand U.S. LNG Imports

To counteract trade imbalances and reduce the risk of further tariff escalations, at least six Asian nations have committed to increasing liquefied natural gas (LNG) imports from the United States. The lifting of the U.S. LNG export moratorium in January has allowed for an estimated 100 million tons of annual LNG production by 2031.

- Japan, the second-largest LNG importer, is committed to expanding U.S. LNG imports to address its $56 billion trade deficit with the U.S.

- South Korea seeks greater energy security and plans to increase U.S. LNG purchases, especially amid global geopolitical tensions.

- India & Taiwan are exploring LNG trade agreements to improve trade relations with the U.S.

- Bangladesh has signed a deal to purchase up to 5 million tons of U.S. LNG annually.

- Vietnam, a new LNG importer, sees expanded U.S. trade as an opportunity to ease tariff tensions.

Taiwan’s Semiconductor Industry Under Scrutiny

Taiwan’s role in the global semiconductor supply chain is now under the spotlight as the U.S. seeks to bring chip production onshore. Taiwan Semiconductor Manufacturing Company (TSMC), the world’s largest contract chipmaker, faces uncertainty as the U.S. considers imposing tariffs on foreign-made semiconductors.

- Deputy Economy Minister Cynthia Kiang is currently in discussions with U.S. officials to minimize potential trade disruptions.

- TSMC executives are meeting in Arizona to assess how U.S. policies could affect operations and investments.

- Analysts warn that U.S. semiconductor tariffs could disrupt ongoing subsidy agreements and hinder global supply chains.

South Korea’s Economic Forecast Downgraded

The Korea Development Institute (KDI) has revised South Korea’s 2025 economic growth forecast to 1.6%, a 0.4% decrease from earlier predictions.

- The downgrade reflects concerns over the impact of U.S. tariffs on South Korean steel, aluminum, and semiconductor exports.

- South Korea also faces domestic economic instability, with consumer spending slowing and political uncertainty following the impeachment of President Yoon Suk Yeol.

- Policymakers are exploring diplomatic negotiations and international partnerships to safeguard economic stability.

Market and Economic Implications

Following the tariff announcement, Asian stock markets displayed mixed reactions:

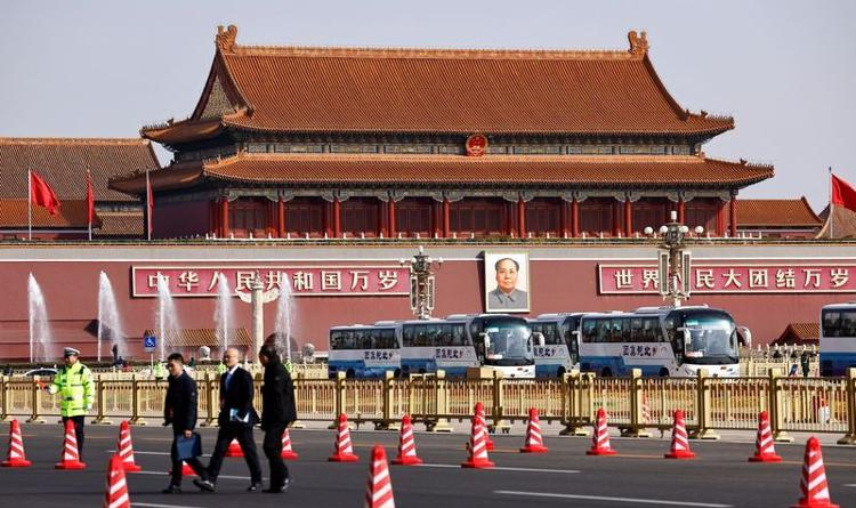

- Hong Kong markets showed fluctuations

- Shanghai and Singapore indices declined

- Seoul, Sydney, and Taipei saw moderate gains

Meanwhile, gold prices hit an all-time high of $2,938, as investors sought safe-haven assets amid rising trade tensions.

Experts caution that U.S. protectionist policies may yield short-term economic gains but could disrupt global supply chains and increase consumer prices. While Asian economies are adapting through strategic trade shifts, the long-term trade outlook remains uncertain, with the potential for economic and geopolitical consequences.