Futures linked to Wall Street’s main indices saw slight gains on Thursday as investors prepared for a wave of corporate earnings reports, while a pause in the escalation of U.S. President Donald Trump’s tariffs provided some market relief.

Among the notable companies set to report before the bell are drugmaker Eli Lilly (NYSE:LLY), industrial giant Honeywell International (NASDAQ:HON), and luxury brand Ralph Lauren (NYSE:RL). Amazon.com (NASDAQ:AMZN), scheduled to report after the market closes, faces pressure to meet high expectations for its cloud computing business.

At 04:58 a.m. ET, Dow E-minis were up 89 points (0.2%), S&P 500 E-minis gained 12.25 points (0.2%), and Nasdaq 100 E-minis rose 34.25 points (0.16%).

Most large-cap and growth stocks saw slight upticks, with Nvidia (NASDAQ:NVDA) advancing about 1% in premarket trading.

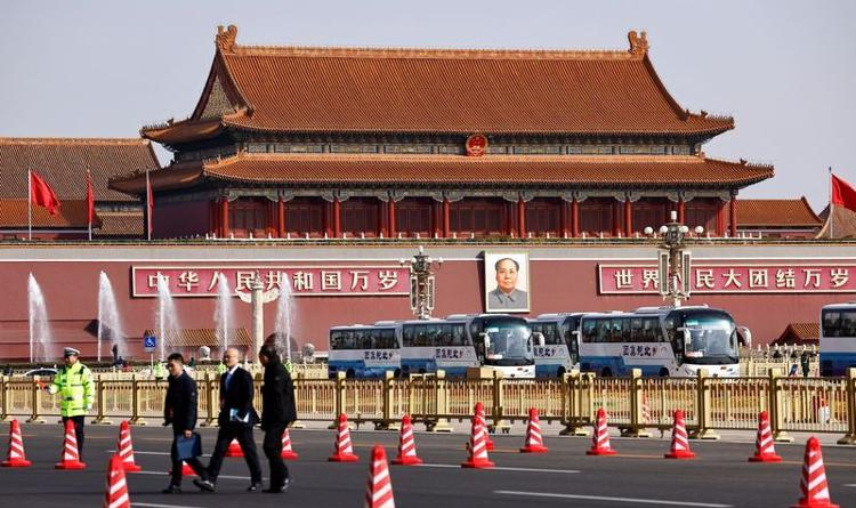

The market had a rough start earlier in the week when Trump introduced broad trade tariffs over the weekend. However, a temporary suspension of tariffs on goods from Mexico and Canada gave markets some relief on Monday. Despite uncertainties surrounding the new administration, Wall Street generally felt reassured as the situation didn’t worsen, particularly concerning retaliatory tariffs from China.

“Markets may have breathed a temporary sigh of relief as U.S. tariffs against Canada and Mexico are put on hold for now, and China’s initial retaliatory response is considered restrained,” said Mark Haefele, chief investment officer at UBS Global Wealth Management.

Federal Reserve Vice Chair Philip Jefferson stated overnight that he was content to keep the central bank’s policy rate unchanged until there is a clearer understanding of the effects of the Trump administration’s policies on tariffs, immigration, deregulation, and taxes.

Traders do not expect any action on interest rates from the U.S. Federal Reserve in its upcoming March meeting, though a rate cut is widely anticipated in June, according to CME’s FedWatch.

Analysts believe that Trump’s tariff plans could drive up domestic inflation, which may slow the Fed’s rate cuts.

A weekly jobless claims report is set to be released before markets open, leading up to the important January nonfarm payrolls report on Friday.

All three major indexes closed higher in a volatile session on Wednesday, bringing the S&P 500 just 1% shy of its all-time record high.

Among early movers, U.S.-listed shares of Arm Holdings (NASDAQ:ARM) dropped 4% after slightly beating current-quarter expectations but falling short of the upper end of its previous full-year forecast. Qualcomm (NASDAQ:QCOM) fell 4.8% after its executives indicated that its profitable patent-licensing business wouldn’t see sales growth this year, following the expiration of an agreement with Huawei Technologies. Ford Motor (NYSE:F) lost 4.9% after forecasting up to $5.5 billion in losses for its electric vehicle and software operations this year. Skyworks Solutions (NASDAQ:SWKS) plunged 29.1% after the Apple (NASDAQ:AAPL) supplier warned of lower revenue in its mobile segment and projected current-quarter profits below estimates.